What Is a Paydown?

A paydown is a reduction in a company’s, government’s, or consumer’s overall debt. It’s common in business to issue a new round of corporate bonds at a lower price than the previous one. As a result, the company’s debt load is reduced. A paydown is when a consumer makes a greater payment on a mortgage, car loan, credit card, or any other type of debt in order to reduce the outstanding principal.

Example of a Consumer Paydown

Making extra principal payments toward a mortgage is a common example of a consumer paydown.

Assume a homeowner has 20 years of payments left on a $300,000, 30-year mortgage with a 5% interest rate. Their monthly payment will be around $1,610 (principal and interest).

If they put an extra $100 toward principal each month, they would save $15,250 over the life of the loan and pay it off nearly two years sooner.

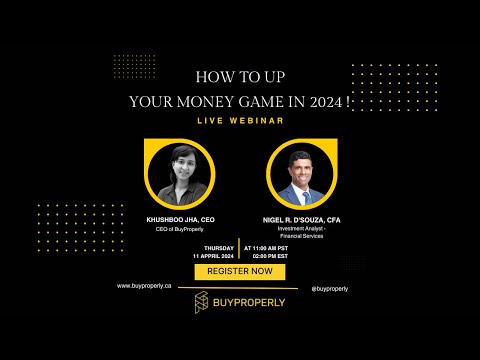

Are you looking for a new investment property? We can assist you! We offer a fractional ownership concept at BuyProperly, which allows investors to start with as little as $2500!

We’ve simplified a procedure that was previously complex, time-consuming, and costly. We locate and acquire the greatest properties using our industry expertise and AI technology, resulting in top-performing rental properties and fantastic investment prospects for you to grow your wealth. Take a look at our properties.