Investing in real estate can definitely be a lucrative endeavor, but it’s not without its risks.

Before you decide to jump into the world of property investment, it’s important to understand the pros and cons of doing so. In this blog post, we’ll take a look at some of the key factors you need to consider before making your decision.

Let’s dive in!

Pros of Investing in Real Estate

Here’s a list of the pros of investing in real estate:

1. You can make money in (almost) any market

Real estate is the ultimate equalizer. If you’re in a good market where prices are rising, then you’ll be able to make some solid profits on your investment.

However, even if you’re in a bad market where prices are falling or stagnating, there’s still a way to make money. The key is to invest in a property that’s increasing in value, which will enable you to sell at a higher price than what you originally paid for it.

Ultimately, real estate comes down to supply and demand – if there are more people looking for homes or rentals than there are properties available, then the prices will rise, whereas if there’s less demand than there are properties on the market, prices will fall.

What this means is that no matter where you invest, even in an area that’s suffering from low demand or weak support from an economy, as long as you find a troublesome property that meets your criteria for investment (more on this later), then you’re still able to make profits by buying it at a lower price and selling at a higher one.

2. Real estate is an effective hedge against inflation

Inflation is the gradual decline in the value of money over time while demand for goods and services rises, which also drives up prices and costs of living.

Inflation can make it difficult to afford everyday things like groceries and gas, but investing in real estate offers some measure of protection from its effects by enabling you to increase your income regardless of whether or not the economy’s doing well or on shaky ground.

In addition, real estate provides protection against inflation. The value increases year-over-year and landlords can raise the rent to adjust for the cost of living.

Regardless of inflation or deflation, you’ll be able to rent out your properties for more than what you’re paying to keep them repaired and maintain their values (and hopefully even add some upgrades), helping you build equity faster.

3. Real estate offers tax benefits

In most areas, investors can write off expenses related to rental properties on their taxes including interest, repairs, and travel costs.

Even if you’re making a decent profit from your rental properties, it’s still possible to offset some of your yearly income through tax deductions related to depreciation and home office use, so there are still opportunities for savings.

4. You can diversify your investments with real estate

One of the worst things an investor can do is put all their eggs into one basket. By spreading your investment across various sectors and geographies (such as real estate), you limit your risk and increase the likelihood of getting a good return on your investment.

Another pro of investing in real estate is that you can act as your own bank by leveraging the equity in your properties to invest in other opportunities.

5. It’s easy to get started investing in real estate

As long as you have enough money on hand to put down a deposit, real estate is one of the easiest investments to get started with – all you need is a little bit of research and some elbow grease to find the right property for investment!

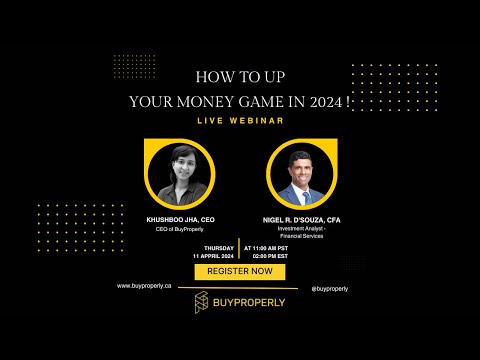

If you don’t have the huge downpayment necessary to secure your first property, consider starting with fractional ownership. Here at BuyProperly, we use a fractional ownership model to allow investors to get started for as little as $2500! You’ll invest in a share of a property and earn both an income stream and capital appreciation over time.

Learn more about our platform here.

6. There are plenty of investors looking for new opportunities

One of the pros of investing in real estate is that there’s always something to find, whether it be a foreclosure, auction, or otherwise. Even if you can’t find anything on your own, you can usually contact an agent who specializes in commercial properties and they’ll be able to direct you towards any new listings as soon as they come up – sometimes even before they hit the market!

7. Real estate is a relatively safe investment

Real estate is generally considered to be one of the safer investments. Property values generally have predictable increases year-over-year, rental markets aren’t subject to severe market fluctuations, and real estate is an asset protected from rising inflation.

So if you want something that won’t tank your savings or put your family’s welfare at risk, it might be time to go hunting for some properties!

Cons of Investing in Real Estate

Here are some of the cons that may dissuade people from getting into the world of real estate:

1. You’ll need money upfront before making any profit

One thing that often deters many new investors is having enough capital on hand before they can make their first purchase, as real estate has some pretty hefty up-front costs.

If you’re buying a home (and not getting one specifically to rent out), then you’ll need enough cash on hand to cover the down payment and closing costs – this could be anywhere between 10% to 20% of the property value depending on your plans for it and what kind of interest rates the bank is offering at that time.

Learn how we help new real estate investors get started for less! Visit BuyProperly!

2. Real estate requires a lot of maintenance

When you buy a house or an apartment, you’re taking over all responsibilities related to keeping it in good repair. This means being ready to pay for whatever necessary renovations or improvements might be needed from time to time, which could set you back hundreds or thousands of dollars.

3. Highly illiquid market

Real estate markets tend to be highly illiquid, which means that it could take weeks (or even months) for you to close a sale or find another investor who wants to buy your property or equity stake at its current market value.

This can make it especially difficult if you need cash right away – unless you can borrow against your investment quickly, then it may not be possible to do anything until after you’ve sold the property. If there are no other buyers available when you do want to sell, then you might have to take a loss on your investment or hold onto the property until you can find someone who is willing to make a purchase.

Sometimes potential investors may want to buy a property at a lower price than what it can earn or sell for in order to turn a quick profit if they need cash right away, but you might not be able to accommodate them unless it’s something that you’re willing to do yourself.

And if no one else is interested in purchasing the property once they learn about its potential value, then you may have to hold onto it for a while until you’re able to find someone who wants it at your asking price.

If liquidity is important to you, consider looking at alternative forms of real estate investing. For example, we use a fractional ownership model which allows several investors to buy into properties for less money than required for traditional real estate. In addition, investors have the ability to sell their shares before 5 years is up, making it a more liquid investment than traditional investing.

4. Turnover takes time and money

Before you’re able to start making profits from a potential real estate investment, it may take months before there’s anyone interested in renting out or buying the property that you’ve chosen.

This means that if you need quick cash flow, then real estate investments aren’t going to do anything for you at all – they’re slow turn-around investments.

In order to buy a good rental property with good returns on its value, you’ll have to spend some time learning about market conditions so that you can find properties with the highest likelihood of growing in price over time as well as find renters with the highest chances of staying in your properties long-term (and who will pay their rent on time every month) – and you’ll have to spend some money for this research, too.

5. Bad tenants, damage, and vacancies

Even if you find great renters who are willing to move into your properties right away, there’s always the chance that they could stop paying their monthly payments (especially when times get tough), which means that you’ll be stuck with financial problems in spite of all your hard work.

Not only will you lose out on rental income, but repairs might also cost money that could be better spent elsewhere.

6. Real estate values can vary significantly

If you invest in only one region, only one type of property, or even in just one neighborhood in a city, then you could be missing out on potential profits if there are other parts of town that see better growth over time. If your investment strategy is too narrow, then it will be difficult to make up for any missteps or bad investments that you might have made when benchmarking the area’s average values against your own.

7. Real estate markets provide relatively slow returns on their investments

Real estate markets tend to generate slower returns than other business models, which means that you may not be able to take advantage of any potential profits if you need immediate cash flow.

When compared to other investments like stocks and bonds, real estate is considered a lower risk investment, but it also tends to have slower growth rates overall – which means that if your money is tied up in real estate, then it might not grow as quickly as other types of investments would.

Conclusion

So, what should a new investor do when it comes to real estate investing? It depends on their goals and individual situation. No one investment strategy is right for everyone; the key is finding the best fit for each person’s unique needs.

Real estate is an incredibly stable and lucrative investment to add to any new investor’s portfolio. With the right time, dedication, and research, most new investors will be able to see success from their real estate investments!

Hopefully this article has helped equip you with the knowledge you need to make an informed decision about your own investments.

Are you thinking of investing in real estate? Check out our properties and see what fractional ownership can do for you!