There are a few different ways to calculate ROI depending on the type of real estate investment you have. Let’s look at how to calculate ROI for real estate investments that are resales OR rental investments. Let’s look at some examples.

Resales

When calculating the profitability of resale real estate investments, there is a simple formula:

Your equity in the property (total gains minus your total costs) divided by total costs.

There are 2 methods real estate investors can use to calculate their gains and costs: the Cost Method and the Out-of-Pock Method. Let’s look at them both in detail.

Cost Method

This method for calculating ROI uses the total equity in a property divided by that property’s costs (renovations, repairs, and sale price). The Cost Method works for properties purchased with both cash and/or financing.

As an example, say you purchase a home for $250,000. After putting in an additional $100,000 for repairs, you sell the property for $500,000.

First, you need to calculate your equity in the property. If it sold for $500,000 after your total costs were $350,000 for the purchase and repairs, you had $150,000 left of equity.

Next, calculate the total costs. As mentioned above, the total costs for the property were $350,000 ($250,000 purchase price plus $100,000 in repairs).

After you divide your equity ($150,000) by the total costs ($350,000), you get 0.43 which is a 43% ROI.

Out-of-Pocket Method

The second popular method for calculating ROI looks at only what you’ve spent out- of-pocket for property costs and expenses and doesn’t consider the property financing.

When would investors use this method? The Out-of-Pocket Method can be used to calculate ROI only when investors purchase a property with a mortgage. Both the down payment and financing on the property are

calculated as equity, making the overall ROI higher.

Let us discuss the same example as above.

You purchased the property for $250,000 and put $100,000 of repairs, only this time, let’s say you put a 20% down payment on the house and used a traditional mortgage to finance the rest.

This means your out-of-pocket expenses are only $50,000 (your down payment) plus $100,000 (repair costs).

If the property is worth $500,000 after repairs, this means you have $350,000 of equity (including you bank financing as leverage). After you divide $350,000 by the total sale price ($500,000) you’re left with a 70% ROI.

Rental properties

Calculating ROI on rental properties is slightly more complex since we need to factor in year-over-year profitability.

For this ROI, we use the following formula:

Net operating income (annual rental income – operating expenses) divided by the total mortgage value…

Using the example from above, if you purchased your property for $250,000 with a 20% down payment, that means your mortgage is $200,000.

Now, let’s say your monthly rent is $1200. Multiply this by 12 to get the average yearly rent. Subtract operating expenses (let’s assume these are $500 a month). This leaves you with a yearly net operating income of $8400.

Divide $8400 by the current mortgage value ($200,000) and you’re left with an ROI of 4.2% per year. Keep in mind, as the mortgage value decreases over time, the ROI increases.

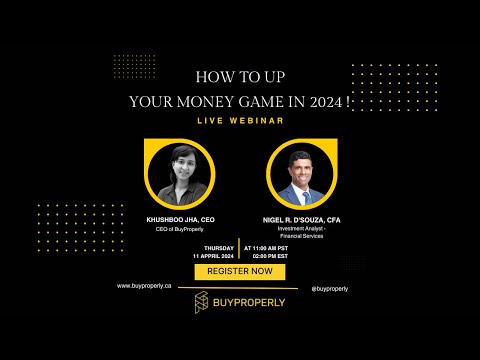

Read about How to Calculate ROI in Real Estate to Maximize Your Profit | Buyproperly